An earlier posting on complementary currencies and its importance in a local economy created some discussions. I'd like to comment further on that. This is also in response to two messages that went over the Living Economies mailing list. You can read them here and here.

Giving it some deeper thought, it is not the actually the circulation of money locally that is ultimately important, but the CREATION of money locally.

There are several different ways that money can be created. It depends if a particular currency is cash-based or if it is wealth-based. Mutual credit currencies like LETS are created as a debt – and there is nothing wrong with that. In LETS, the debt incurred by currency creation is a debt to a community of people. In the conventional money system, the debt is incurred to a (often international) bank. The process used by banks to create money is called fractional reserve banking. This process has an additional twist: the payment of interest. It is the involvement of interest in the money creation process which is at the core of the problem, which contributes to the constant redistribution of wealth from the poor to the rich, the redistribution from the fringes to the centre and, I believe, it is also ultimately responsible for our environmentally destructive economics.

Therefore the best way to address those problems is to issue money locally, in a healthy way. Give the power to issue money to the people instead of businesses.

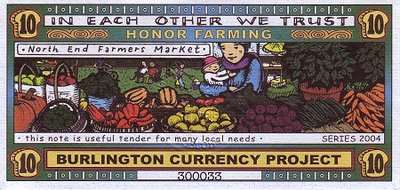

(picture: 10 slices of Burlington Bread, USA, issued interest free)

(picture: 10 slices of Burlington Bread, USA, issued interest free)The second posting sounded to me a bit like neo-liberal propaganda. The writer shows little or no understanding of complementary currency and how it might be applied to local economics.

It is a common misconception that when we say 'interest-free', we mean that money shouldn't give any return when invested. We may debate if getting an income without work (that is what returns on investments are), especially when little or no risks are involved, is ethical or not. The writer himself wrote that “The core problem is the human desire to get more of something for less work on their part.”

However, the real issue around interest-free money is how this money is created. He writes that 'creating alternative currencies which do not permit interest are complicated' – the actual fact is that virtually all complementary currencies are created without interest.

Again, any discussion of this topic is only meaningful if the process of fractional reserve banking is understood. When licensed banks create money by loaning it to their customers with interest, then scarcity is created, together with all the resulting negative effects. It is key to understand that more than 98% of the money supply is created by loans incurring interest (Reserve Bank of New Zealand figures). If all that money is due to be paid back, plus interest – where does the additional money for the interest come from? Fractional reserve banking has an influence on the money supply. Here in NZ we have the additional twist to the story that any reserve ratio has been abolished in 1985; monetary policy is entirely conducted by the setting of interest rates.

When credit unions loan money to their members against interest, then no new money is created, and therefore the interest charged has no influence on the money supply as a whole. Neither does interest returned on investments influence the money supply. While it is possible to issue a complementary currency without interest, it would also be possible to invest it with interest returned on investments. However, where interest is involved, one always creates a redistribution mechanism that funnels money from the poor to the rich ...

That is why it is important to note that ancient religious prohibitions against usury (interest) applied to all kinds of interest taking. From that arose the principles of islamic banking for example, which prohibits interest taking, and promotes among other things the sharing of profit and loss and joint-venture.

No comments:

Post a Comment